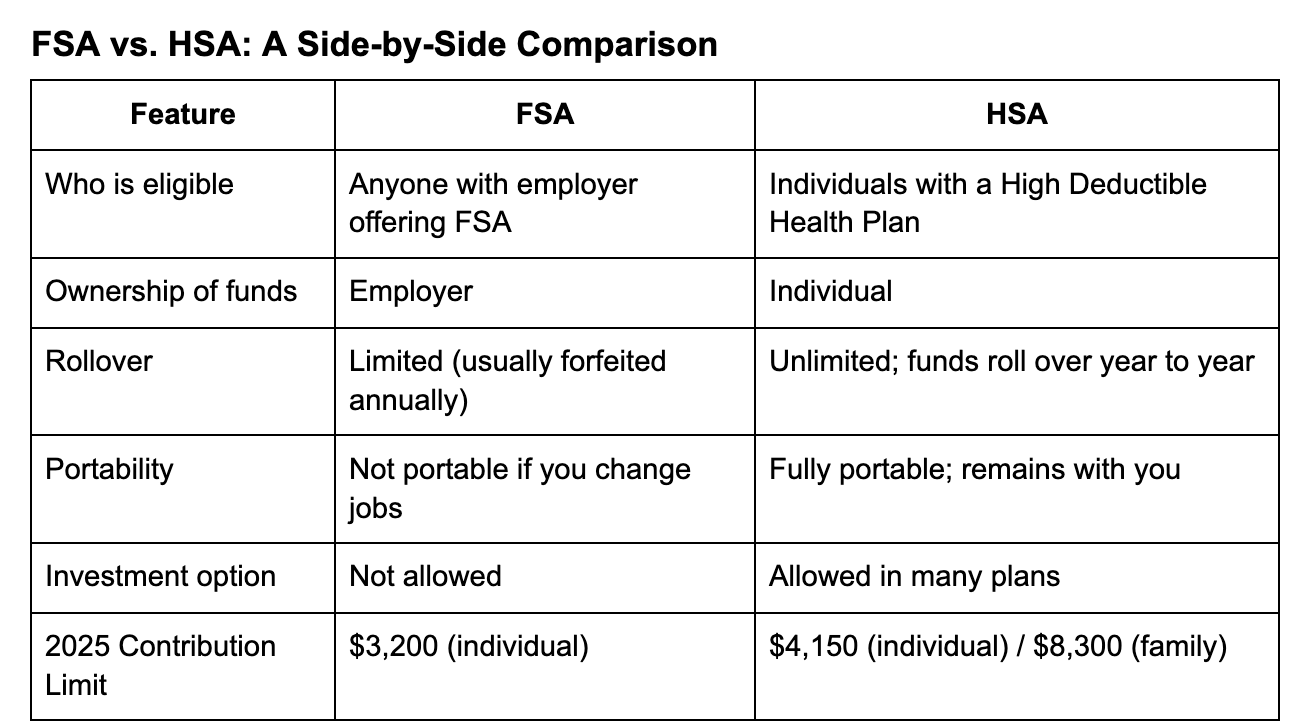

Navigating healthcare expenses can be overwhelming, but tools like FSAs (Flexible Spending Accounts) and HSAs (Health Savings Accounts) can help you manage costs while prioritizing your health. Whether you're investing in chiropractic care, massage therapy, or other wellness services, understanding how these accounts work can help you make informed and cost-effective decisions.

Below, we break down what FSAs and HSAs are, how they differ, and how you may be able to use them at our office.

What is an FSA?

A Flexible Spending Account (FSA) is a healthcare account offered through your employer that allows you to set aside pre-tax dollars to pay for qualified medical expenses.

Key features:

-

Offered through your employer

-

Funded through payroll deductions

-

Funds are generally “use-it-or-lose-it”, meaning they must be spent by the end of the plan year (some plans allow a short grace period or limited carryover)

-

Can be used for a wide range of medical expenses, including chiropractic care, medically necessary massage therapy, acupuncture, and more

What is an HSA?

A Health Savings Account (HSA) is another tax-advantaged account available to individuals enrolled in a High Deductible Health Plan (HDHP). HSAs offer greater flexibility and the ability to save long-term.

Key features:

-

Owned by the individual (not tied to your employer)

-

Funds roll over each year and do not expire

-

Can be used for qualified medical expenses, just like an FSA

-

Contributions are tax-deductible, funds grow tax-free, and withdrawals for qualified expenses are also tax-free

-

Some HSAs allow you to invest the funds for long-term savings

Can You Use Your FSA or HSA at Our Office?

Yes, many of the services we offer are eligible for FSA and HSA reimbursement, including:

- Chiropractic adjustments

- Medically necessary massage therapy (with appropriate documentation)

- Acupuncture

- Orthopedic supports and certain wellness devices

Some services may require a Letter of Medical Necessity from your healthcare provider. Our team is happy to assist with this process if needed.

Why This Matters

Using your FSA or HSA for chiropractic care is a smart way to invest in your health while saving money. By utilizing pre-tax dollars for qualified services, you can lower your taxable income and make regular care more affordable.

We’re committed to making your wellness journey as smooth and stress-free as possible—including helping you understand your benefits and how to use them.

Planning Ahead? If you have an FSA, don’t forget—many plans have a deadline to use your funds before they expire at the end of the year. We recommend booking your appointments early to ensure availability.